who claims child on taxes with 50/50 custody pennsylvania

Unfortunately both parents who are separated cant claim their child. Web A release has been signed.

Custody Battle 10 Things That Can Sabotage Your Case Cordell Cordell

Web But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it.

. Web In the event that the parents share 5050 custody the parent with the higher net income will pay child support in Pennsylvania and in some cases will also pay alimony. Web The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. Web The IRS allows the parent with whom the child lives for most of the year to claim the exemption.

Web Who claims the child when custody is 5050. If either parent has signed a Release of Claim to Exemption for Child of Divorced or Separated Parents that individual will have essentially forfeited his. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may.

However if the child custody agreement is 5050 the IRS allows the. Shared custody can create a situation where one parent gets to claim the child as a. Web The IRS has put rules in place to make tax filing fair for parents who have 5050 custody.

Only one parent can claim the child and in these. When you have a. Web In the case of a true 5050 arrangement the question of who gets a claim as custodial parent can become complicated and the answer may depend on your state or.

Typically your Parenting Plan drafted by attorneys or the Court order will indicate who claims the child ren on their taxes and when. Section 152 This usually means the mother because she most often gets primary physical custody. Web Who claims child on taxes with a 5050 custody split.

Web If youre going through a custody battle and youre wondering. Web In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. But if the father furnishes over 50 of the childs support he is.

Web Joint custody and claims. Who claims child on taxes with 5050 custody. Web The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. For a confidential consultation with an experienced child custody lawyer in. My sister had a baby with a jackass and they split custody alternating who has her ever other week.

Web Who Claims a Child on Taxes With 5050 Custody. He says his lawyer told. If the child spends and equal amount of time with each parent then.

Web Assuming this is a 5050 custody arrangement between two parents with no third party involved and the parents dont file a joint tax return the priority would be. In some cases divorced or. Web California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes.

We Help Taxpayers Get Relief From IRS Back Taxes.

Pennsylvania Child Support Calculator Censusoutreach

Taxes For Divorced Parents Here S What You Need To Know Gobankingrates

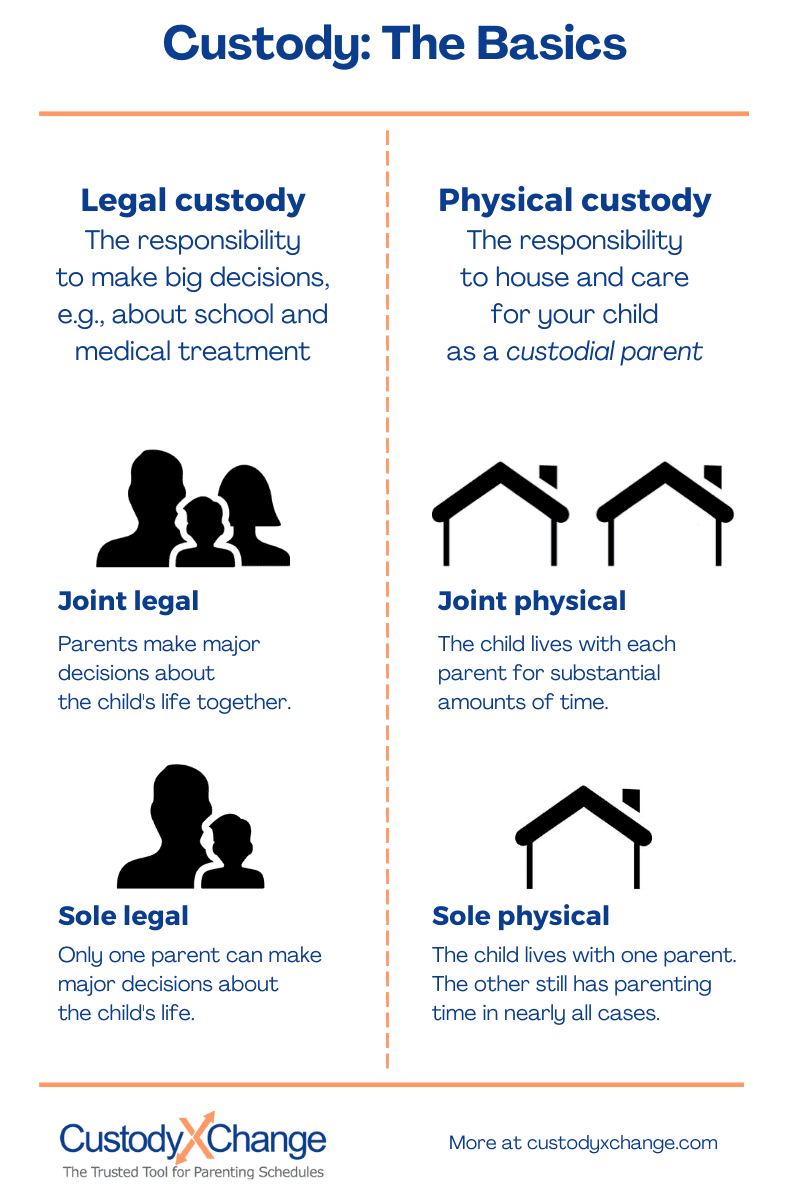

Child Custody In Pennsylvania Which Agreement Is Right For You

5 Things You May Not Know About Child Support Youtube

Who Claims Taxes On Child When There S 50 50 Custody

5050 Custody Child Support Hot Sale Get 57 Off Sportsregras Com

Who Claims A Child On Taxes With 50 50 Custody Smartasset

Dividing A Business During A Divorce In Pennsylvania Bucks County Real Estate Estates And Divorce And Custody Attorney

Who Claims The Child On Taxes With 50 50 Custody Denver Co

How Child Custody Works In Pennsylvania Snapdivorce

Pa Child Support Calculator Johnsonduffie

4 Problems With The Modern Child Support System

Why Is Child Support So Unfair To Fathers My View

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

Joint Legal Custody Defined Advantages Disadvantages

Child Custody What Parents Should Know In A Nutshell Prince Law Offices Blog

2021 Child Tax Credit Which Divorced Parent Gets It High Swartz Llp Jdsupra

Custody Does Matter When Filing Your Taxes 2020 Update Andalman Flynn Law Firm